Naveen Kukreja, Co-Founder & CEO, shares his experience with The Economic Times on how he overcame a financial crisis and the lessons learnt from it (September 2, 2024)

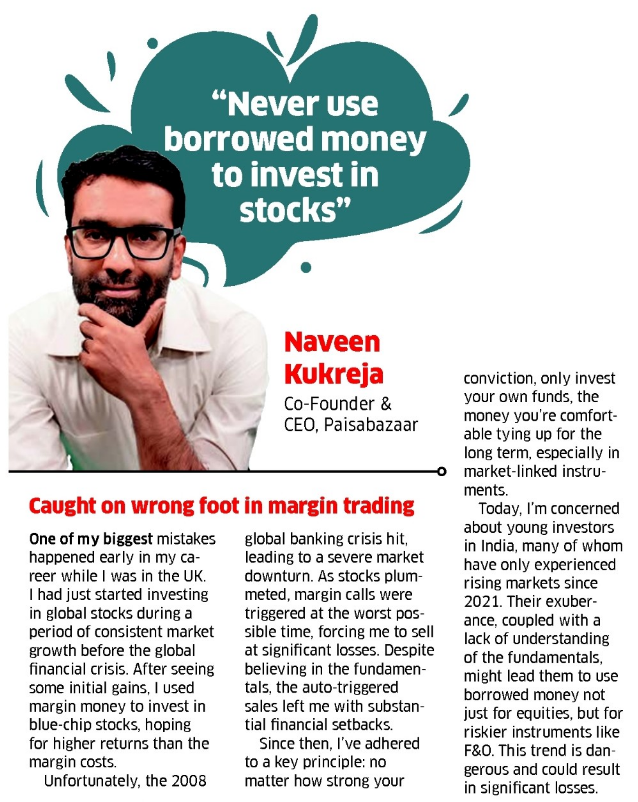

Mistake: A big mistake that I made was very early on in my career when I was in the UK. That was the time when I started investing in global stocks. I was very new in the field and before the Global Financial crisis, the market was growing consistently. I had seen some initial gains and excited by those gains, I made a mistake of using margin money for investment in blue chip stocks. Being new to the investment market, I had hoped that I would get higher returns from those investments that I was paying on the margins.

However, as luck would have it a Black Swan event happened with the global banking crisis in 2008, leading to a recession. Overnight the stocks declined dramatically across the world and I made losses. What happens in margin money is that the margin calls happen at the worst time which is when the stock is at its lowest level and is going down. And, even if you are convinced about the fundamentals and you want to hold on to the stocks, the sales are auto-triggered. Since you sell at the worst possible time, the losses can be significant.

Since then, I have stuck to just one principle, whatever your conviction, only use your own funds that you are comfortable investing over a long period of time, especially for market-linked instruments.

One of the biggest concerns I have today in the Indian investment market is that many new and young investors have only seen markets going up post 2021. And too much exuberance and not understanding the fundamentals, may make them use borrowed money to invest in not only equities but also in even more risky instruments like F&O. This is a dangerous trend and could lead to high losses.

Top advise: Never borrow to invest. Loans are not for speculative purposes and should only be used for a financial need when you are short of funds.

Investment should be done using your own money – surpluses that you do not need in the short run. For market-linked instruments, ensure to invest over a long period of time (at least 5 years). This would ensure any short- and medium-term ups and downs in the market, which are inevitable, do not affect you.

My preferred asset class is equities. As an asset class, it has outperformed fixed-income instruments over the long term by a wide margin. Any new investor should consider equity mutual funds for their long-term needs, unless you have a low risk appetite. Experts and advanced investors, who have time and knowledge, can invest directly in high-conviction stocks, otherwise equity mutual funds are the best instruments.

My Investment Strategy: The starting point of my investment strategy (and that has been my advise to all new investors) was to ensure I have adequate life and health insurance that provides cover in case of any unforeseen events, followed by creating an emergency fund large enough to take care of 12 months of my mandatory expenses. This is parked in a high-yield savings account or Bank FDs.

Once that was taken care of, my investment strategy has been largely investing in equity, through mutual funds and also in direct stocks, where I have high conviction and knowledge about the company and the industry, for instance financial services. I also invest a smaller but certain portion in fixed income instruments, ranging from FDs to public listed bonds. I also have a small allocation to gold, through a consistent investment format. I do not invest in real estate, it’s only for personal use.

An edited version of this article is published in The Economic Times on September 2, 2024.